From the Qajar era to post-1979, Iran's currency experienced significant changes and fluctuations in

Iranian Rial

From the Qajar era to post-1979, Iran's currency experienced significant changes and fluctuations in value, impacted by various economic policies and internal and international political conditions. The currency evolved from the toman and gheran in the Qajar period to the rial during the Pahlavi era, influenced by economic policies aimed at strengthening it.

From the Qajar era to post-1979, Iran's currency experienced significant changes and fluctuations in value, impacted by various economic policies and internal and international political conditions. The currency evolved from the toman and qheran in the Qajar period to the rial during the Pahlavi era, influenced by economic policies aimed at strengthening it.

Qajar Era (1794–1925)

During the Qajar era, the primary currency units were the toman and qiran. One toman equaled 10 qirans, and one qiran was worth 20 shahis. The currency was mainly in coin form and based on the value of silver and gold, making it vulnerable to fluctuations in international metal prices. In addition, heavy foreign debts and foreign interference in Iran’s economy led to a significant devaluation and instability of the national currency.

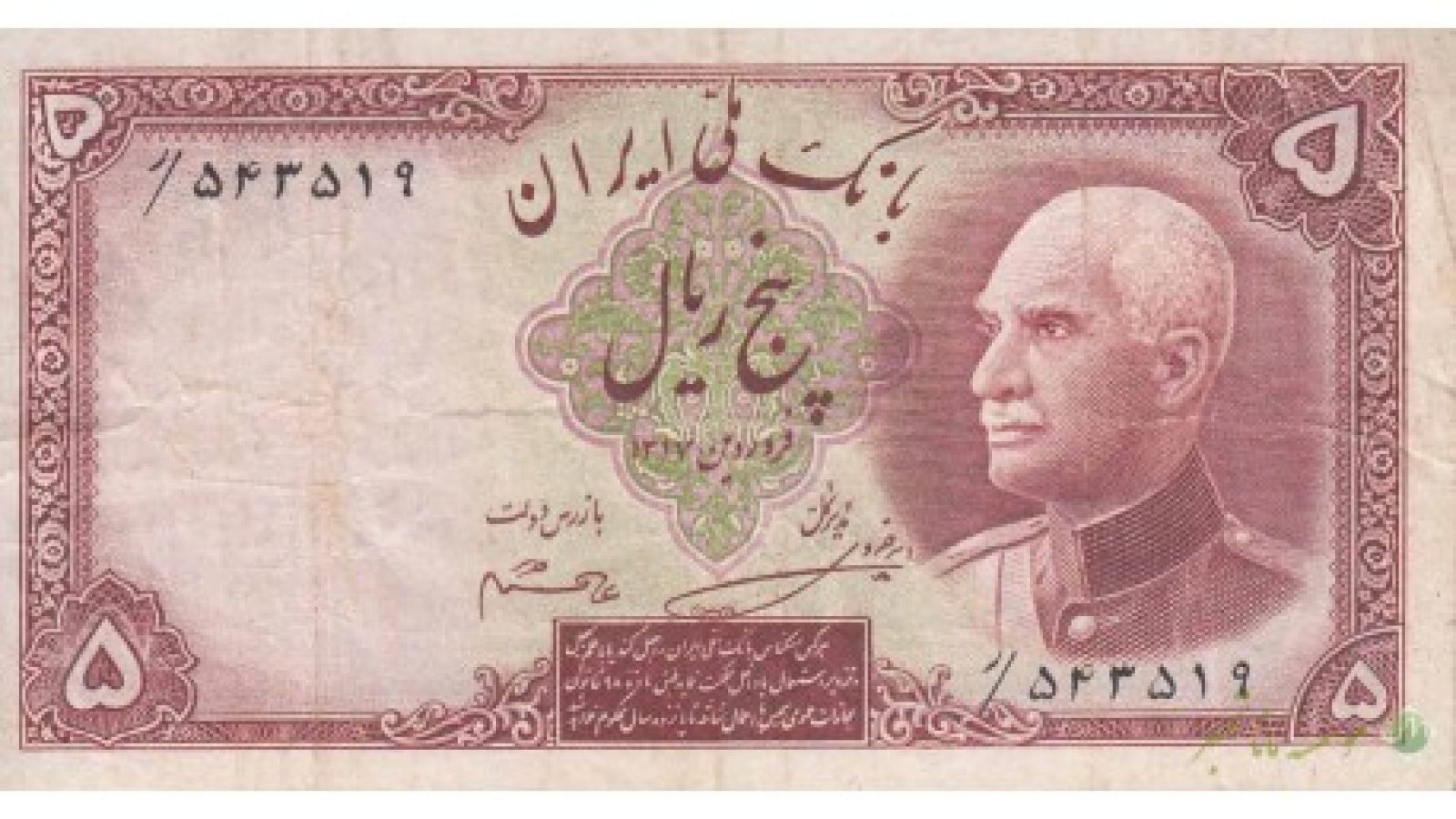

Pahlavi I Era (1925–1941)

With the rise of Reza Shah and the beginning of modernization programs, Iran’s monetary system underwent key reforms. In 1928, the rial was introduced as the new currency unit, replacing the qiran, and was set equal to 100 dinars. The establishment of the National Bank of Iran in 1927 played a crucial role in controlling currency issuance, stabilizing the economy, and fostering confidence in the rial, bringing relative stability to Iran’s currency.

Pahlavi II Era (1941–1979)

During the reign of Mohammad Reza Shah, Iran’s economy grew rapidly, especially with the oil price boom in the 1970s. The Pahlavi government utilized oil revenues to maintain and strengthen the rial’s value through various economic policies. Some key policies included:

1. Exchange Rate and Inflation Control: The government maintained a stable exchange rate and controlled inflation, preserving the rial's value against the U.S. dollar.

2. Infrastructure Investment: Expanding transportation networks, building dams, and promoting local industries diversified Iran’s economy, reducing dependency on imports of essential goods.

3. Support for Agriculture and Domestic Industries: Developing agriculture and domestic industries reduced the need for imports and helped maintain foreign currency reserves.

4. Central Bank Establishment and Money Supply Oversight: Oversight by the Central Bank and the National Bank of Iran helped control the issuance of money, which contributed to the rial’s stability.

5. Oil Revenue Management: Oil revenues were used to build reserves, strengthen the rial, and position Iran as one of the stronger economies in the region.

Post-Revolution and Iran-Iraq War Period (1979–1988)

After the 1979 revolution, Iran’s economic structure shifted dramatically, and the rial faced substantial pressure. The Iran-Iraq War (1980–1988) further strained the economy.

Capital Flight: Post-revolution, significant capital flight weakened Iran’s foreign reserves and devalued the rial.

Impact of War on Economy and Rial: The war led to reduced domestic production and oil exports, causing a sharp decline in the rial’s value and high inflation.

Government Currency Controls: The government implemented strict currency controls, introducing multiple exchange rates, which created price disparities between the official and open markets.

Reconstruction and Sanctions Period (1989–2011)

After the war, Iran entered a reconstruction phase, implementing new economic policies to rebuild industries and infrastructure. However, international sanctions gradually impacted the economy and the rial’s value.

Economic Reconstruction Program: In the 1990s, economic reforms aimed at rebuilding infrastructure and industries helped the economy grow, but the rial remained under pressure.

International Sanctions: From the 2000s, especially due to nuclear issues, banking and currency sanctions on Iran restricted foreign currency access and further weakened the rial.

Conclusion

From the Qajar period until the 1979 revolution, Iran’s monetary system underwent significant changes, with the rial introduced under the Pahlavi regime and strengthened by government policies. Following the revolution and Iran-Iraq War, the currency faced challenges from internal crises, capital flight, and international sanctions. These events illustrate the broad impact of economic policies and political conditions on the value of Iran's currency over time.